Part 3 Report on performance

Overview

The Commission's performance report is based on an assessment of its results for the year using a range of criteria. Three sets of criteria have been adopted by the Commission to enable a thorough assessment of all aspects of its operations. Broadly, the criteria encompass:

- how well the object of the Act has been met by the Commission's decision making;

- how fair and effective the Commission has been in dealing with applicants and interested parties; and

- how efficient the Commission has been in the use of financial resources available to it.

The Commission's assessment of its performance against each of these criteria is set out below.

Results against performance targets

Serving the object of the Act

The object of the Act is to enhance the welfare of Australians by promoting economic efficiency through competition in the provision of international air services. Under the Act, the Commission's functions are to make determinations; review determinations; and provide advice to the Minister about any matter referred to the Commission by the Minister concerning international air operations. In fulfilling its functions, the Act requires the Commission to comply with policy statements made by the Minister under section 11 and to have regard to Australia's international obligations concerning the operation of international air services.

The Commission records annually the number of determinations and decisions (involving reviews and variations of determinations) made for the year. The volume of activity varies from year to year. The dominant factor underlying the Commission's output is the number of applications made by airlines. The demand for new capacity from the Commission is directly related to the level of demand for air services. In turn, international aviation activity is particularly sensitive to factors such as changes in the strength of the economy and the emergence of security threats, among others.

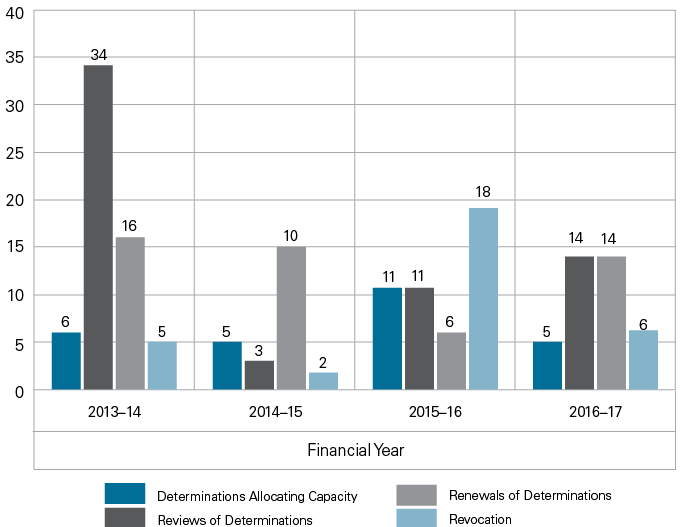

In the financial year 2016–17, the Commission issued five determinations allocating new capacity; 14 renewal of capacity allocations; 14 decisions varying various determinations including a resolution to extending the date of utilisation of the capacity; and 6 decisions revoking capacity allocations.

The number of applications for renewal of determinations has decreased considerably in the last three years since the Commission implemented in 2014 a process of allowing airlines to consolidate determinations. The consolidation process enables an Australian carrier to bring together some or all of its existing capacity entitlements allocated in various determinations into a single determination. The consolidation of determinations has considerably streamlined the capacity allocation process of the Commission as it lessened the number of applications for renewal of determinations and for variation of conditions. The consolidation of determinations made in the last three financial years impacted the total number of applications made to the Commission this year.

The graph below shows comparative data of the current reporting period (2016–17) with the three preceding years.

Historical numbers of determinations and decisions

In 2016–17, five determinations allocating new capacity were made. The allocations reflected the expansion of overseas services by the Australian carriers.

A new carrier, Norfolk Island Airlines, applied for and was issued unlimited passenger capacity on the New Zealand route. In its application, Norfolk Island Airlines indicated it plans to offer two weekly services on a Boeing 737–300 between Norfolk Island and Auckland. The services will be operated under a wet lease arrangement between Norfolk Island Airlines and Nauru Airlines, a foreign-registered carrier operating under an Australian air operator's certificate. As Norfolk Island Airlines is a new carrier and has not previously operated regular international air public transport services, the Commission sought advice from the Department of Infrastructure and Regional Development to determine if the airline would reasonably be able to obtain the necessary regulatory approvals to operate on the New Zealand route. Likewise, as the actual carrier operating the services between Norfolk Island and Auckland would be Nauru Airlines, the Commission also sought advice from the Department if Nauru Airlines would be reasonably able to obtain the necessary regulatory approvals to operate the service. The Department, in response, advised that they do not foresee any reason why Norfolk Island Airlines, or Nauru Airlines, will not be able to secure the necessary regulatory approvals. The Norfolk Island Airlines and Nauru Airlines operated their first service between Norfolk Island and Auckland on 17 June 2017. This service effectively replaces the Norfolk Island-Auckland flights which were operated by Air New Zealand until May 2017.

Pacific Air Express, an Australian carrier which currently holds capacity allocations on the Vanuatu, Papua New Guinea and Nauru routes, applied for and was issued unlimited freight capacity on the China route. Subject to certain commercial considerations including the ability to obtain suitable slots, Pacific Air Express intends to commence its freight services between Australia and mainland China in November 2017. Pacific Air Express joins Qantas (which operates direct freight services between Sydney and Shanghai), Federal Express (Fedex) and Polar Air Cargo in operating freight services between points in Australia and points in China.

Pacific Air Express also renewed its freight capacity on the Nauru route and had its capacity allocation increased to unlimited frequency consistent with the amendments made to the Australia-Nauru air services arrangements.

Qantas was allocated seven weekly frequencies of new capacity on the Vietnam route to enable its wholly-owned subsidiary Jetstar to operate services from Sydney and Melbourne to Ho Chi Minh City. Jetstar commenced its services to Ho Chi Minh City in May 2017.

After returning some unused capacity on the Indonesia route in April this year, Qantas applied for and was granted, in June, 100 additional seats of passenger capacity on the route.

During the reporting period, the Commission issued 14 renewal determinations.

Qantas renewed its capacity allocations on the following routes:

- Fiji for the use of Qantas' wholly-owned subsidiary, Jetstar, which operates services between Sydney/Gold Coast and Nadi;

- France with permission to code share with British Airways and Emirates;

- Korea with permission to code share with Asiana Airlines;

- Papua New Guinea with permission to code share with Air Niugini on the Brisbane/ Sydney- Port Moresby sectors;

- South Africa;

- Thailand with permission to code share with Bangkok Airways, British Airways, Emirates Airways, Finnair, Jet Airways and Jetstar Asia;

- United States of America with permission to code share with its wholly-owned subsidiary and American Airlines;

- United Arab Emirates with permission to code share with its wholly-owned subsidiary and Emirates; and

- Singapore to be used to exercise own stop-over rights between Singapore and Colombo and with permission to code share with Emirates and SriLankan Airlines.

Virgin Australia, on the other hand, renewed its capacity allocations on the following routes:

- Fiji;

- Italy for the provision of code share services with Singapore Airlines and Etihad Airways;

- Singapore for the exercise of own stop-over rights between Singapore and Colombo with permission to codes share operated by Singapore Airlines to Colombo via Singapore; and

- Solomon Islands.

The Commission made six decisions revoking certain determinations upon the application of the airlines. Qantas had determinations revoked on the Taiwan route; and while it revoked its determinations on the China route, it replaced them with one determination allocating unlimited capacity and frequency. As mentioned earlier, Qantas reduced its capacity allocation on the Indonesia route by revoking its determination.

Virgin Australia ceased operating its own services to the United Arab Emirates and as a result sought a revocation of its determination on the route.

Additionally, as a result of the conclusion of revised air services arrangements between the aeronautical authorities of Australia and Taiwan during the year, capacity used for code share services is no longer counted under the arrangements. On this basis, Qantas sought, and was granted, revocation of its determinations on the Taiwan route.

As in previous reporting periods, an area of significant work for the Commission is assessing applications by the airlines to use their allocated capacity for code sharing with another carrier. Out of 14 reviews of determinations conducted by the Commission, as initiated by the Australian carriers, 12 related to code sharing.

During the reporting period, the Commission approved Qantas' applications to vary multiple determinations to permit code sharing with Air Niugini on the Brisbane-Port Moresby and Sydney-Port Moresby sectors; Fiji Airways on the Singapore route; Jet Airways on the Thailand route; and on the Singapore and Thailand routes, for code sharing between Jetstar and Finnair.

Virgin Australia sought and was granted variations of multiple determinations to permit the use of the capacity for code sharing with Hong Kong Airlines on the Hong Kong route; and with Air Berlin, Air Canada, Alitalia and Hong Kong Airlines on the trans-Tasman route.

A brief summary of all determinations and decisions for 2016–2017 is at Appendix 1. A detailed description of each case is provided at Appendix 2.

The Commission's full determinations in these cases are available from its website, iasc.gov.au.

Case Study—Papua New Guinea

Introduction

In previous annual reports, the Commission has highlighted one of its more complex cases to provide an insight into how it assesses applications which raise contentious and difficult issues. This year, the Commission's case study focusses on the differences between blocked space and free sale code sharing as illustrated by the Qantas applications to permit the use of capacity entitlements to provide code share services, under free sale arrangements, with Air Niugini on the Papua New Guinea (PNG) route.

The application

On 25 August 2016, Qantas applied to the Commission for a variation of three determinations allocating capacity on the PNG route to enable reciprocal code sharing with Air Niugini under new free sale arrangements. In its application, Qantas indicated it planned to code share on passenger services operated by Air Niugini between Port Moresby and Brisbane/Sydney/Cairns, while Air Niugini planned to code share on Qantas-operated passenger services between Brisbane and Port Moresby.

At the time of the application, Qantas had a total allocation of 1,888 seats per week of capacity on the PNG route. Of the 1,888 seats allocated to Qantas, the Commission authorised 1,000 seats for code sharing, under a hard block arrangement, on the Brisbane-Port Moresby and Sydney-Port-Moresby city pairs operated by Air Niugini.1 The Port Moresby-Cairns sector was excluded and was independently operated by both Qantas and Air Niugini. The remaining capacity allocation of 888 seats per week did not have permission to be used for code share services2.

The Commission's previous approval was due to expire on 30 June 2017; hence the application of Qantas to renew the approval for code sharing but under free sale arrangements. In its application, Qantas proposes to:

- continue code sharing with Air Niugini on Brisbane-Port Moresby and Sydney-Port Moresby sectors but under a free-sale arrangement; and

- add Cairns-Port Moresby under the authorisation to code share on a free-sale basis, following Qantas' withdrawal of its own-operated services between Cairns and Port Moresby and commencement of Brisbane-Port Moresby own-operated services.

In its initial application, Qantas stated that the application should be assessed against the general criteria for assessing public benefit in paragraph 4 of the Minister's Policy Statement. Paragraph 4 provides for the threshold criteria which every carrier making an application to the Commission should attain—that is, the carrier is reasonably capable of obtaining all regulatory approvals and of implementing its proposed service.

The Commission asked Qantas to provide a supplementary application addressing the additional criteria set out in paragraph 5 of the Minister's Policy Statement. The paragraph 5 criteria comprise competition, tourism, consumer, trade and aviation industry benefits including any other criteria which the Commission may consider relevant, with competition benefits as the pre-eminent consideration.

Qantas' supplementary application

In its supplementary application, Qantas submitted that:

- the proposed (free sale) code share arrangements are consistent with and provided for under the air services arrangements between Australia and PNG and that these commercial entitlements should be readily accessible by carriers to compete with existing or potential carriers to whom equivalent rights are available;

- the proposed code share will enable Qantas to maintain a presence on the Cairns-Port Moresby sector offering additional options when flying between Australia and PNG;

- Qantas and Air Niugini independently price and sell services on the PNG route with each airline operating separate yield management systems, creating a competitive dynamic; each carrier offers separate fare structures resulting in varied fare levels and fare conditions, giving passengers more choice and flexibility;

- the presence of other competitors, and the potential for new entrants, continues to act as a real competitive constraint on both Qantas and Air Niugini;

- the proposed code sharing would ensure that Air Niugini remains an operator and competitor on the route, as it would continue to support the viability of Air Niugini's B767 services which provide combined passenger/cargo services;

- the continued operation by Air Niugini of regular B767 services is vital to carriage of palletised and containerised freight;

- Qantas is only in a position to code share with Air Niugini on the PNG route on a free-sale basis (and its hard block code sharing would cease from 30 October 2016);

- Qantas and Air Niugini have extensive domestic networks with their respective home markets which are accessed by both carriers currently only by interline arrangements. Under the proposed code share, Air Niugini will code share on domestic services within Australia operated by Qantas. This will provide more ‘destination Australia' travel options and itineraries for Air Niugini to market;

- code sharing has supported the ongoing viability of Air Niugini and as such, has been of vital importance to the PNG economy.

Submissions

From the application to the draft decisions, the Commission received a total of nine submissions from the following: the Australian Competition and Consumer Commission (the ACCC), Virgin Australia, Air Niugini, Pacific Air Express, Qantas, two members of the public (Michael Murphy and Brad Jackson) and the Australia-Papua New Guinea Business Council.

Australian Competition and Consumer Commission

At the outset, the ACCC noted that it is providing this submission without having had access to information that is relevant to evaluate the likely competition effects of the proposed code share arrangement like airline load factors and profitability on the Australia-PNG route and that the ACCC's submission is focussed on issues of principle to inform the IASC's assessment.

The ACCC stated that from a competition perspective, a hard block code share is preferable to free sale since each carrier has an incentive to market their allocated seats independently. Under a hard block arrangement, which places full commercial responsibility on the marketing carrier for a fixed number of seats, each carrier has an incentive to market their allocated seats independently of each other including different prices. Under free sale there is little incentive to compete on price because the marketing carrier only pays for the seats it sells.

The ACCC also noted two significant changes in the competitive environment since 2012: (1) the exit of Airlines PNG in July 20143 on the Brisbane-Port Moresby sector which it operated since 2005; and (2) that passenger traffic between Australia and PNG remained relatively stable between January 2011 and June 2016, in contrast to the strong growth (an average of 12.4%) in the five years preceding to the 2012 IASC decision. The ACCC stated that the IASC should have regard to the reduction in the number of competing carriers and the stability of passenger demand in assessing the likely competitive impact of the (free-sale) code share arrangement.

In looking at the likely future with and without the code share, the ACCC noted that without the code share, the Brisbane services would be independently operated and marketed by three competitors—Qantas, Air Niugini and Virgin Australia. On the Cairns-Port Moresby and Sydney-Port Moresby sectors, Air Niugini would be the only operating and marketing carrier. In the event that Air Niugini were to significantly raise price or reduce services on these sectors, there would seem to be a real chance that either Virgin or Qantas would enter and contest these services.

With the code share on the Brisbane sector, Qantas and Air Niugini would be able to market each other's services, and there would be less competition in the marketing of their capacity. On the Cairns and Sydney sectors, Qantas would be able to market Air Niugini capacity, which makes it less likely that Qantas would commence operating its own services on these sectors should Air Niugini significantly raise price or reduce service on these sectors. This leaves Virgin as the main source of competitive constraint on these sectors.

The ACCC further stated that the proposed free sale arrangement has the potential to lessen competition between Qantas and Air Niugini; however, the ACCC said that without the opportunity to examine load factors and profitability on the route or consider the extent of the competitive constraint that Virgin Australia is likely to provide, the ACCC is not in a position to form a clear view on the likely effect on competition. It further stated that given the other significant changes occurring in conjunction with the application—operational changes by Qantas, change from hard block to free sale and uncertainty about the likely effect on competition—it is open to the IASC to grant an approval for a shorter duration than requested.

Virgin Australia

In its non-confidential submission, Virgin Australia stated at the outset that the Qantas applications should be rejected on the basis that the proposed use of the capacity for unrestricted code share services will not be of benefit to the public. Concerns raised by Virgin Australia included:

- Qantas' applications do not address, nor even acknowledge, the persistent strong concerns of the Commission over many years regarding the impact on competition of the code share with Air Niugini on the PNG route;

- in the financial year 2016, Qantas and Air Niugini together carried more than 80% of passengers on the route, with the remainder carried by Virgin Australia and such a powerful presence, limits Virgin's ability to compete effectively;

- the increased cooperation (between Qantas and Air Niugini) would entrench their combined market power and the dominance of that partnership would create a significant deterrent for any competitor to enter or expand on the route;

- the absence of attractive routes via third countries, particularly for business travellers, means the potential for third country carriers to provide competitive constraint is extremely limited. Virgin wishes to include a third country code share provision in the air services arrangements so its alliance partners can code share on its Brisbane-Port Moresby services to support the sustainability of these services;

- the Brisbane-Port Moresby sector where Qantas proposes to implement parallel code share arrangements with Qantas and Air Niugini offering code share services on the other's flights, will enable Qantas and Air Niugini to offer double daily service compared with Virgin's six weekly services. Over time, this could erode the performance and threaten the viability of Virgin's services;

- in relation to the Cairns-Port Moresby and Sydney-Port Moresby sectors, if the proposed (free-sale) code share arrangements between the two strongest operators were approved, it would be more difficult for a new entrant to commence services on the route, given the prospect of competing with Air Niugini and Qantas in combination, each with a dominant position at one end of the route; the challenge for a new entrant would be even greater, if the arrangements include frequent flyer program cooperation, on a route dominated by business traffic;

- refusal of the code share would reduce the combined market power of Qantas and Air Niugini thus creating the conditions to support the entry of new carriers or potential expansion of services by Virgin Australia as the only other competitor on the route;

- given that Air Niugini now appears to be in a sustainable financial position, arguments suggesting that code sharing is necessary to ensure the ongoing viability of Air Niugini are tenuous.

Qantas' response to Virgin Australia's submission

In its response to Virgin Australia's submission, Qantas submitted that refusing the code share would be contrary to the intent of the Australia-PNG air services treaty/agreement. Qantas stated that the previous hard block code share arrangement led to market distortions as services on the route do not attract an even distribution of demand across the week and lack depth, meaning the hard block requires the purchase of capacity which the code share partner cannot use. It further alleged that the absence of regulatory approval for code sharing on the Cairns sector contributed to Qantas' withdrawal of services on that sector.

Air Niugini

With the proposed code sharing, Air Niugini intends to:

- increase its Cairns services, from 11 F70/F100 flights to at least 14 per week, following Qantas' withdrawal on this sector;

- increase its Sydney services, from two B737 services to three per week;

- continue its wide body services because Qantas' support (by selling seats through its extensive customer network and base) is critical to Air Niugini achieving sufficient loads for viable wide body operations. However, with Qantas introducing daily flights, it will not be sustainable for Air Niugini to maintain 13 services per week.

Without the proposed code sharing, Air Niugini would need to review its services on Cairns, Brisbane and Sydney. There is a risk that, without the revenue contribution from Qantas seat sales, Air Niugini would withdraw from the Sydney sector and would likely withdraw its wide body services on Brisbane as it would not be sustainable. The code share will enable Air Niugini to operate more efficiently on all sectors as it will allow it to achieve higher load factors as seats can be sold through Qantas' wider network and marketing channels.

Other stakeholders

Two members of the public made separate submissions in support of the proposed code share arrangements. One made a submission before a draft decision was issued by the Commission; the other, after the draft decision was released.

Both members of the public observed that the cessation of Qantas' services on the Cairns sector meant that Air Niugini would be the only airline offering services on the route. Both persons supported the proposed code share on the Cairns-Port Moresby sector as it would result in a choice of either Air Niugini or Qantas ticketing and would provide incentive for price competitiveness.

The Australia-Papua New Guinea Business Council expressed concern on the Commission's draft decision to disallow the proposed code share between Qantas and Air Niugini on the Cairns-Port Moresby sector. The Council said the rejection of the code share will leave Air Niugini as the monopoly operator on the Cairns sector and would be ‘deleterious to Australian business interests generally'. The Council underscored the importance of Cairns as a gateway between Australia and Papua New Guinea and that Cairns would be less attractive for travellers if Air Niugini holds a monopoly on the sector.

The Decision

The Commission issued Draft Decisions and stakeholders were given the opportunity to make further submissions.

In its Final Decisions4, the Commission varied the three determinations and granted permission for the capacity allocations to be used for free-sale code sharing by Qantas and Air Niugini on the Brisbane-Port Moresby and Sydney-Port Moresby sectors until 30 June 2018. The Commission did not grant permission for free-sale code sharing on the Cairns-Port Moresby sector.

Process and rationale

In accordance with the requirements of the Act, the Commission invited submissions from the public. Consistent with its administrative procedures, the Commission published the Qantas applications and all non-confidential submissions on its website and notified interested parties by email. In making its decision, the Commission considered all submissions received.

In light of potential competition issues and concerns from various stakeholders, the Commission decided it would apply the additional criteria set out in paragraph 5 of the Minister's Policy Statement in addition to the general criteria in paragraph 4. Qantas was invited to submit a supplementary application addressing the paragraph 5 criteria of competition, tourism, consumer, trade and aviation industry benefits and any other criteria which it believed the Commission may consider relevant.

Assessing the applications using the paragraph 5 criteria enabled the Commission greater scope to assess the impact on competition of the proposed free-sale code sharing on the PNG route and its benefit to the public. It was also consistent with the approach taken by previous Commissions in assessing the code share application of Qantas on the PNG route.

Brisbane-Port Moresby / Sydney-Port Moresby

Code sharing on the PNG route has been the subject of concern over a series of Commission decisions since 2002. Code share arrangements on the Brisbane-Port Moresby and Sydney-Port Moresby sectors have previously been approved on the basis of hard block code share arrangements between Qantas and Air Niugini. A blocked space code share arrangement moves some risk of the flight to the marketing carrier (Qantas) as the seat block must be paid for regardless of its utilisation. If the market softens, the marketing carrier has an incentive to discount some of its fares (even below the average seat cost) to stimulate the market and to generate traffic that makes some contribution towards the sunk cost of the seat purchase. This risk assumed by the marketing carrier provides a degree of public benefit from the code share.

The shift from hard block to free-sale code share arrangement between Qantas and Air Niugini moves the commercial risk on the flights from Qantas to Air Niugini and would likely lessen Air Niuguni's competitive position. However, the Commission considered that the potential lessening of competition on the Brisbane and Sydney sectors is offset by the introduction by Qantas of a daily service operated in its own right on the Brisbane-Port Moresby sector, increasing to three the number of competitors on that sector. These flights not only serve the Brisbane market, but can consolidate connecting traffic from other Australian cities. Also, the introduction of a third Air Niugini B737 service on the Sydney sector adds frequency and capacity for travellers.

In terms of consumer benefits, the Commission considered there is little evidence that the code share between Qantas and Air Niugini over the years lowered airfares. Qantas' yields on both the Brisbane and Sydney sectors have been consistently high. However, the code share benefitted consumers by providing better connectivity to domestic flights offered respectively by Qantas and Air Niugini.

On a route with such a high proportion of business related traffic, frequency and convenience of schedule are arguably more important for most passengers. Although high fares do add to the cost of doing business, better connectivity can reduce overall travel cost and travel time. Travellers are likely to welcome the increased competition and choice of service that the return of Qantas to the Brisbane sector will bring. They will now have the choice of three differing on-board products, and as price is less important on this sector than most, quality of service will be an important factor in determining which carriers are the most successful. However, the consumer benefits will be partially offset by Qantas' decision to withdraw from the Cairns sector.

On the Sydney-Port Moresby sector, while Air Niugini is the only carrier servicing the sector operating three services per week, the Sydney service faces competition from connecting services from Brisbane operated by all three airlines (Virgin Australia, Qantas and Air Niugini).

In terms of trade benefits, the Commission considered that without the code share, the viability of Air Niugini's 767 services could be jeopardised. The Commission considered that the loss of the B767 aircraft (as a result of the code share being rejected) would be significant, both for Australian exporters and for trade between the two countries generally.

The Commission decided to approve the code share arrangements on the Sydney and Brisbane sectors. However, it considered there was uncertainty about the impact of the shift from hard block to free sale code share. For this reason, it decided to grant approval for a shorter period than requested, until 30 June 2018, with the view to reviewing the arrangement should Qantas seek an extension.

Cairns-Port Moresby

Previously, the code share approval by the Commission was on Sydney and Brisbane sectors only. Qantas has now requested to expand the code share, under a freesale arrangement, to Cairns-Port Moresby sector with Qantas ceasing its own operations on this sector and leaving Air Niugini to be the sole provider of service on the sector.

The Commission considered that approving the code share on the Cairns sector would entrench the monopoly position of Air Niugini as sole operator on the sector. If the code share were approved on this sector, Qantas would not be expected to price below the airfares offered by Air Niugini. The code share would only result in putting a higher barrier for other entrants to operate on the sector. The combined market power of the code share partners would likely close the market from a third airline which might consider operating a competitive service, because instead of competing against only one operator (which may have a dominant position at one end of the route), it will compete against two (Qantas and Air Niugini, each with a dominant position at one of the two ends).

Observations

The Commission continues to monitor the PNG market and notes that even without the code share, Air Niugini has increased its services between Port Moresby and Cairns from 11 to 14 per week (nine F28–70 and six F28–100). Air Niugini has also increased its weekly services between Port Moresby and Sydney from two B737 services to three; and has maintained its seven wide body services per week using B767–300 between Port Moresby and Brisbane.

As the Commission indicated in its decisions, should Qantas wish to extend the authorisation for code sharing, it may seek a review of the code share arrangements some time next year.

1 Decision [2012] IASC 215 varying Determination [2011] IASC 132

2 Determination [2014] IASC 105

3 According to Virgin Australia, PNG Air exited the Cairns-Port Moresby sector in December 2013.

4 [2016] IASC 220, 221, 222

Serving applicants and interested parties

The Commission uses the detailed commitments set out in its service charter as the framework for assessing its service performance. The specific undertakings in the service charter encompass both the ways in which the Commission engages with interested parties and how it makes its decisions. This framework provides the basis for an objective assessment of the Commission's performance.

Again this year, clients were invited to assess the Commission's performance by completing an electronic questionnaire. The questions allow respondents to evaluate how well the Commission performed against each of the specific undertakings set out in the charter. Questionnaire responses may be made anonymously, although some of those responding chose to disclose their identity. The Commission very much appreciates the effort made by respondents to provide their views on the Commission's performance.

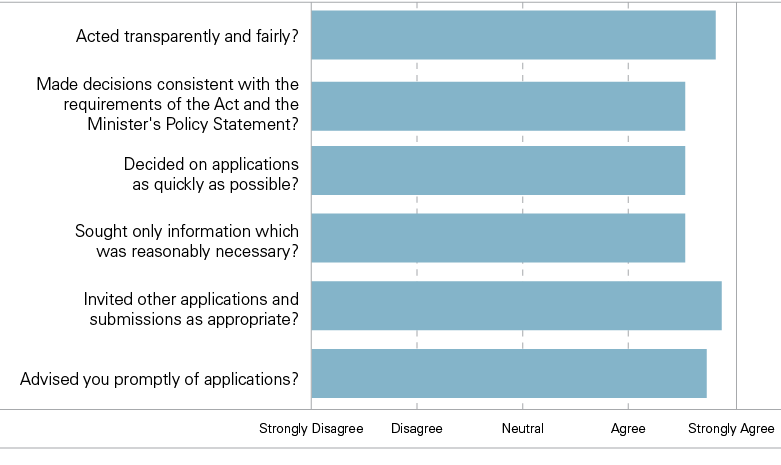

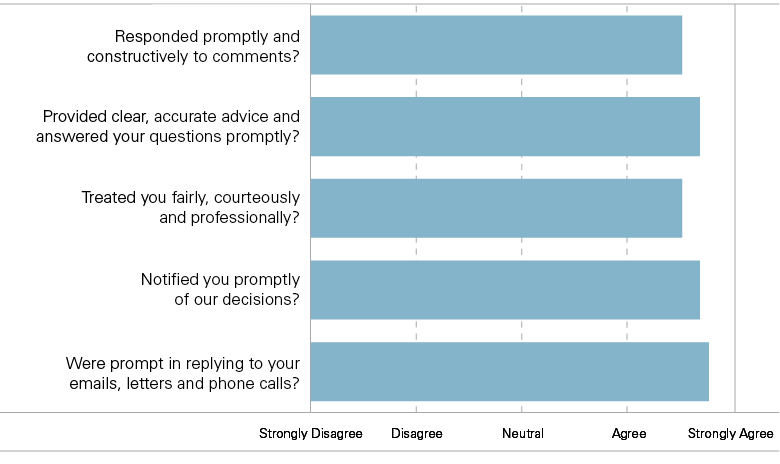

Each year, respondent scores against each criterion are aggregated and averaged. For 2016–17, the Commission's over-all performance was rated above average, which indicates that stakeholders continue to rate the Commission's performance favourably.

The following charts summarise the feedback from stakeholders of the Commission's service performance during the year:

Decision making process—Do you agree that we:

Dealings with stakeholders—Do you agree that we:

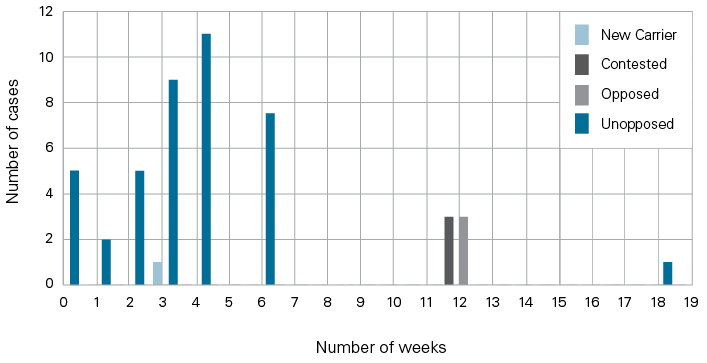

The Commission also records the time taken to make each of its decisions, as it considers timeliness to be a particularly important performance benchmark.

One of the commitments in the service charter is that the Commission will make decisions about uncontested and unopposed applications within four weeks of receipt and contested or opposed applications within 12 weeks, or inform the airline/s involved if there are reasons why a decision may take longer than this.

Except for one case concerning code sharing on the Papua New Guinea route, the applications were uncontested and unopposed. The Commission generally dealt with these straightforward applications within the four-week period. On a number of occassions, decisions fell into the fifth week to align with regular Commission meetings.

The Qantas' application to vary three determinations on the Papua New Guinea route to allow the capacity to be used for code sharing with Air Niugini was opposed by Virgin Australia and generated submissions from various stakeholders, and so took 12 weeks to finalise, well within the timeframe for making decisions on opposed matters as set out in the service charter. A draft decision was made before the decision was finalised, which was also subjected to a consultation period.

One application from Virgin Australia took a longer period (a little over 18 weeks) to complete as the Commission had to await one vital document before a decision could be made.

Detailed information about the Commission's timeliness performance is contained in the following chart.

Distribution of decision times by type of case

Note: The chart does not include the 16 renewal determinations. Renewals are initiated by the Commission on a time frame that suits airlines' requirements and are generally uncontested.

Efficiency of financial resources

The Commission's budget for the year was $443,000. These funds were made available from the resources of the Aviation and Airports Division of the Department. The Commission's budget expenditure is mostly attributable to the salaries and superannuation of Secretariat staff and fees paid to Commission members including superannuation. Other expenditures include the Commissioners' expenses in connection with their travel to Canberra to attend meetings and the production of the annual report. Most corporate overheads and property operating expenditures are paid for by the Department, as the Commission is housed in a departmental building.

The Commission's total expenditure for 2016–17 was about $27,000—less than the allocated budget. The budget anticipated the appointment of a third Commissioner after Mr John King's appointment ended on 31 December 2016. As no appointment was made, the Commission underspent its budget. Discretionary spending was contained within the Commission's budget.

The Commission considers the expenditures to have been made efficiently and effectively. The Commission has delivered steady efficiency gains over a long period. During the year, officers from the Department provided administrative support to the Commission. One external officer was temporarily seconded to the Secretariat as Acting Executive Director when the incumbent was on leave.

Part 5 of this report details the Commission's financial performance.